It’s Not About Bitcoin, It’s About Blockchain

Even if the financial establishment finds a way – which probably will – to monetize Bitcoin in their favor, the blockchain is already in motion and it will be to the financial system of the 2020s what barcodes were to commercial one in the 1980s. But greater.

While the world is discussing if Bitcoin is a bubble or not, Nakamoto (whoever this is) is probably smiling, watching his experiment succeed. “Bitcoin is changing finance the same way the web changed publishing”, can be read in weusecoins.com.

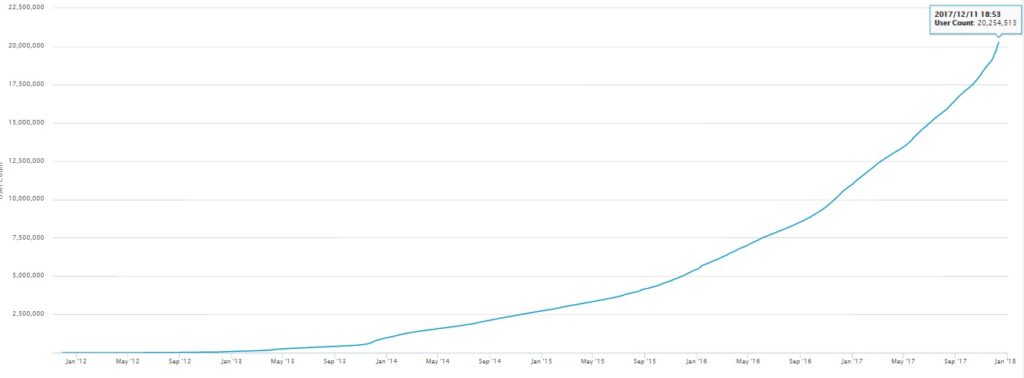

Bitcoin’s technology solves the problem of inflation, double spending, censorship and costly intermediation. No wonder banks are so against it (and investing in it at the same time). The so-called cryptocurrency reached an astonishing value per unit of US$17,539 at the time this article was written.

Bitcoin is a cryptographic file, with a specific number on it which we can use to make transactions online. So far there is nothing to freak out about considering that 92% of all the traditional money in the world today is not physical, as reported by The Money Project. In their research, The Global War on Cash, they state that only in five years, from 2010 to 2015, cashless transactions increased 50%, from 285.2 billion to 426.3. Due to the inflation-based economic system, the buying power of a US$100 bill in 1915 is equivalent today to US$2,390, according to Dollar Times.

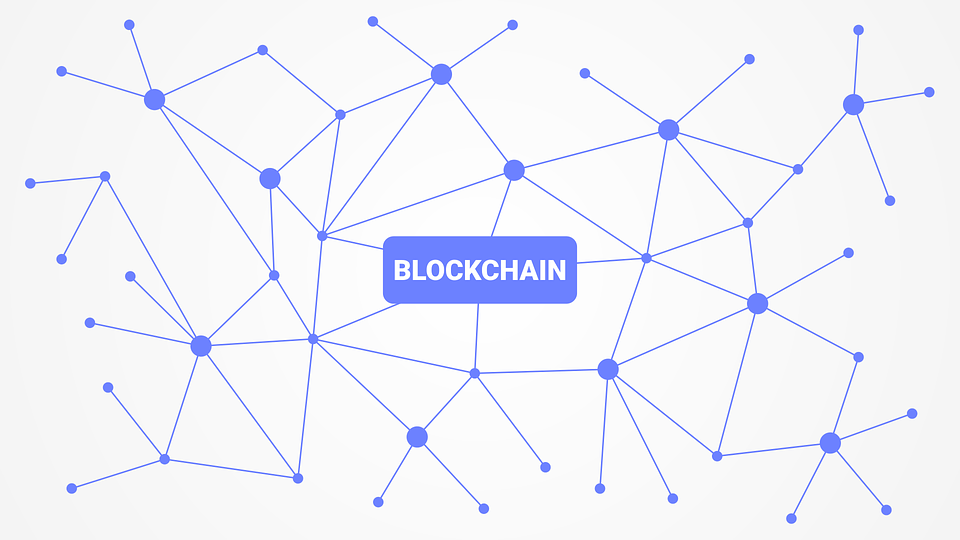

Bitcoins can be divided into a hundred million (100,000,000) fractions. There are 21 million units (enough to give each person in the world 276,315 fractions, valued today in $US48.4), which makes them “completely inflation free”, as explained by their unknown creator, Satoshi Nakamoto in 2009. They can represent many kinds of property, currency or stuff but their truly revolutionary aspect is the technology they roll on: the blockchain.

In words of Alex Tappscot, founder of a firm that invests in blockchain market companies, it is “the internet of value”. Blockchain is a public ledger in a network where transactions are not reversible and allows trade without intermediaries, just like cash. In the introductory video of the official website bitcoin.org: “this means that the fees are much lower, you can use them in every country, your account cannot be frozen and there are no prerequisites or arbitrary limits.”

Even if the financial establishment finds a way – which probably will – to monetize Bitcoin in their favor, the blockchain is already in motion and it will be to the financial system of the 2020s what bar-codes were to commercial one in the 1980s. But greater.